IMF Warns Global Slowdown as Trump Tariffs Cloud Outlook

TOPICSAs the 2025 Spring Meetings of the International Monetary Fund (IMF) and World Bank kick off this week, global financial leaders are sounding the alarm over the slowing growth, potential surging inflation and the disruptive impact of ongoing trade tensions.

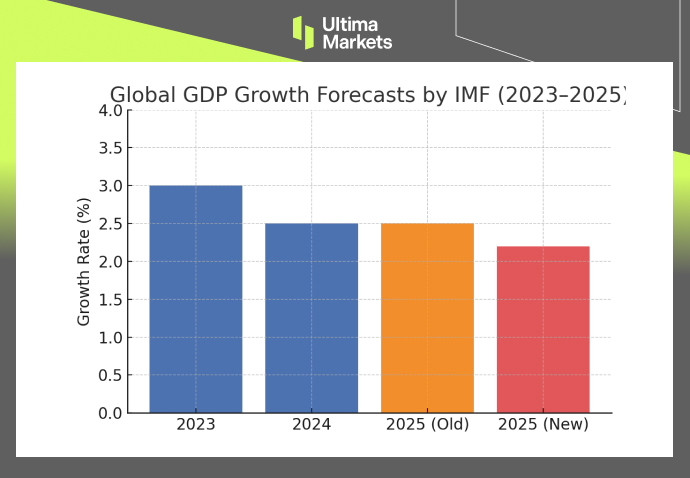

IMF Downgraded 2025 Global GDP Forecast

The IMF downgraded its 2025 global GDP forecast to 2.2% at its Spring Meetings in Washington this week, citing rising trade tensions and fragmented policy responses. U.S. tariffs under President Trump are under scrutiny for triggering volatility and weakening investor confidence.

IMF Global GDP Forecast (2023-2025); Source: International Monetary Fund

The IMF’s updated forecast marks the sharpest downward revision in two years. According to Managing Director Kristalina Georgieva, “persistent trade disruptions and tariff risks” are the main headwinds.

Though the IMF avoided directly condemning the Trump administration’s sweeping tariff agenda, its tone made clear that protectionism remains a key risk to the global economy. The Fund noted that “fragmentation” in global supply chains could become entrenched if the trade war escalates further.

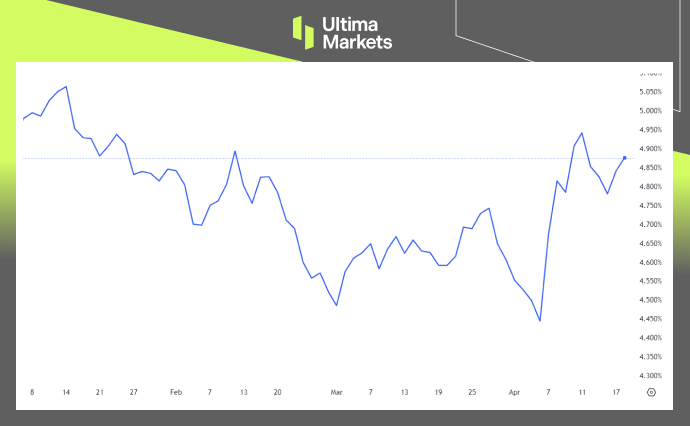

Investors Demand Higher Premiums Amid Fears

The US 20-Year Treasury yield has climbed to a two-month high near 4.90%, as investors demand higher premiums amid escalating trade tensions and deteriorating global trade sentiment.

(US 20-Y Treasury Yield; Source: TradingView)

This rise comes despite growing market expectations for a Fed rate cut in June 2025, with a total of three 25bps cuts priced in for the year, potentially lowering the Fed funds rate to 3.50%–3.75%. The yield surge reflects lingering concerns over the long-term outlook for the US economy under ongoing trade uncertainties.

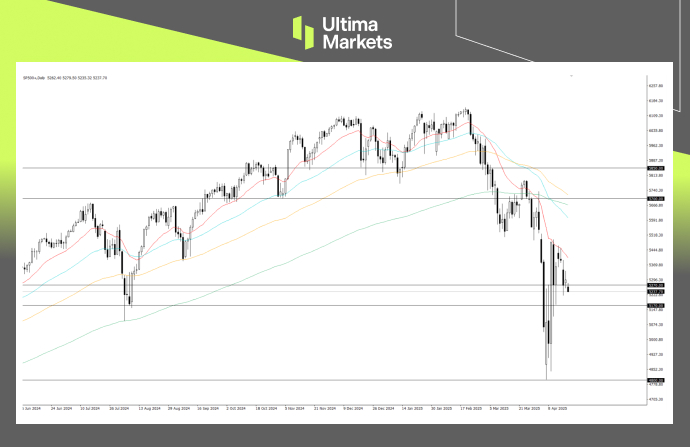

US Stock Market Outlook

The US stock market benchmark, S&P 500 Index (SP500+), has extended its downside in recent sessions, despite a strong rebound on April 9 following Trump’s tariff pause announcement—highlighting fragile market sentiment.

(SP500+, Day-Chart Analysis; Source: Ultima Market MT5)

“With tariff headwinds persisting, a recovery in market sentiment is unlikely in the near term,” said Ultima Market Senior Analyst Shawn.

From a technical standpoint, the bearish outlook remains intact, as the index continues to trade below the key 5400 level, a threshold often viewed as a bear zone for the S&P 500.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server