Please note that this website is not intended for EU residents. If you are located in the EU and wish to open an account with an EU investment firm and protected by EU laws, you will be redirected to Huaprime EU Ltd, a company licensed and regulated by the Cyprus Securities and Exchange Commission with licence no. 426/23.

Dow Jones Hits Record High as US Stocks Rally on Rate Cut Hopes

TOPICSTags: Dow Jones, Nasdaq, S&P 500, US retail sales

Major US stock indices climbed on Tuesday, with the Dow Jones leading gains. The Dow surged 742.76 points (1.85%), marking its second consecutive record close and the strongest performance since June 2023. The S&P 500 rose 0.64%, while the Nasdaq edged up 0.21%. Market sentiment was primarily driven by expectations of Federal Reserve rate cuts. Investors shifted focus from large-cap to small-cap stocks, with industrial shares leading the day’s rally. Notably, Dow components Caterpillar (CAT.US) and Boeing (BA.US) saw increases of 4.28% and 3.87%, respectively.

Corporate earnings reports played a significant role in market movements. UnitedHealth (UNH.US) surged 6.5% after beating expectations, further boosting the Dow. Bank of America (BAC.US) gained 5.35% on strong earnings and revenue, while Morgan Stanley (MS.US) shares climbed 0.91%, surpassing forecasts due to robust trading and investment banking results. In contrast, Charles Schwab (SCHW.US) fell 10.18% following a 17% decline in bank deposits to $252.4 billion and a 6% drop in net interest revenue.

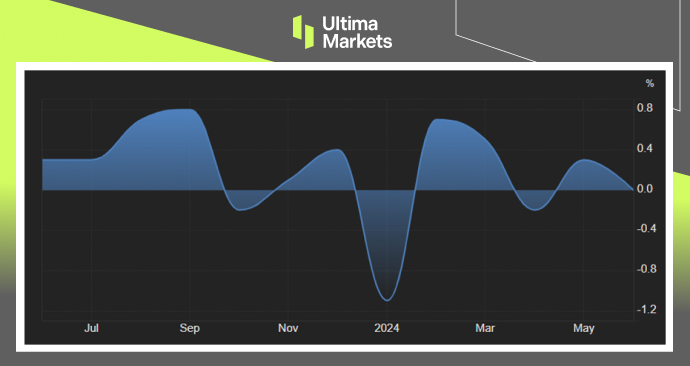

Economic data had mixed impacts on the market. Retail sales in the US stalled in June from May 2024, following an upwardly revised 0.3% rise in the previous period. However, this data had minimal effect on overall market risk appetite, as investors remained focused on the broader economic outlook and potential monetary policy changes.

(S&P500 Index Monthly Chart)

(Retail Sales MoM%,U.S. Census Bureau)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Neden Ultima Markets ile Metaller ve Emtia Ticareti Yapmalısınız?

Ultima Markets, dünya çapında yaygın emtialar için en rekabetçi maliyet ve değişim ortamını sağlar.

Ticarete BaşlaHareket halindeyken piyasayı izleme imkanı

Piyasalar arz ve talepteki değişimlere duyarlıdır

Sadece fiyat spekülasyonu ile ilgilenen yatırımcılar için çekici

Derin ve çeşitli likidite ile gizli ücretler yok

Dealing desk yok ve yeniden fiyatlandırma yok

Equinix NY4 sunucusu üzerinden hızlı yürütme